Kurse zur Verbesserung der Finanzplanung-Fähigkeiten

321 Kurse

Raising Funds for Your Startup

Understand the process of funding a start up Almost all startups need external financing, but new entrepreneurs rarely have training in fundraising. On this course, you’ll learn the basics of financing a start-up. You’ll explore how important financial backing is for success and how to attract and negotiate with investors. This course is also available in French. To join the French run of the course, visit the course page. This course is aimed at entrepreneurs who are considering or preparing a financing round. It can also be useful for students of entrepreneurship or management, and to anyone wishing to get a better understanding of the actors, processes and consequences of a financing round. A general knowledge in business will help, though it is not required. This course is taught by a French team, but all course resources will be in English or subtitled in English.

Fundamentals of Financial Management

Finance is rightly called life blood of business. Every business decision is incomplete without proper knowledge of finance. So, study of finance with its concepts and techniques is essential for all students.After studying this course, students will be able to know the basics of finance along with its applications. This will help students in knowing fundamentals and application of finance and financial management.

Business Growth: Tackling the Scale-up Challenge

Understand the need, concepts and application of this new approach to scale-up Please note this course runs without facilitation There are many approaches addressing early-stage entrepreneurship and the challenges facing mature corporations, but a big gap when it comes to understanding the key drivers for growth and how to address them. This course introduces the Triple Chasm Model, a unique new approach to managing the growth challenge based on research which resulted in two new books: Camels, Tigers & Unicorns and The Scale-up Manual. Supported by lead author, Uday Phadke, you’ll discover why there’s a need for a new approach, the concepts behind the Triple Chasm Model and how to apply them to your venture. EIT Food would like to offer their support to SMEs during the current global health crisis. You can now join this course for the discounted price of £43 / €54. This course is designed for members of leadership teams in innovative high-growth SMEs. It is targeted in particular at CXO level executives including CEOs, commercial directors, technical directors, finance directors, marketing directors, heads of product management, and heads of sales. The Educators won’t be able to join the discussions themselves or respond to individual comments, but the course encourages a strong learning community. The learning is focused around debate and discussion – supporting other learners, sharing your own experience and knowledge, and listening to new perspectives. We hope that you will enjoy interacting with and learning from each other in this way.

ARPIT Refresher Course In Commerce

This course aims to refresh and enhance participants' knowledge in the field of commerce. Students will learn about various topics in commerce and develop skills in areas such as accounting, finance, marketing, and business management. The course uses a combination of lectures, case studies, and practical exercises to help learners grasp key concepts and apply them in real-world scenarios. This course is designed for individuals with a background in commerce who are looking to update their skills and knowledge in the field.

Attaining Higher Education

Attaining Higher Education is a course designed to facilitate the successful transition of active duty service members and veterans to postsecondary education, whether at a two- or four-year college for an associate's or bachelor's degree, or even graduate school. Too often, service members and veterans transition with little information, or incorrect information, about what makes students successfully realize their goals through higher education. Frequently they are left to navigate a difficult and complicated transition to higher education without robust support or complete information. This course is designed to break down the process of transition to education and to assist service members in finding an educational program that fully maximizes their potential. The course: lays out how to approach admissions processes to institutions of higher education guides students through the self-assessment needed to determine if and how to apply wisely challenges students to consider the factors which make a college a right fit for them offers an overview of the college application process, whether at a community college or four-year college provides a summary of the most common sources of financial aid available to many transitioning service members and veterans From intentional decision making--a method through which service members and veterans connect their life and military experiences with a potential academic or career path--to choosing a right fit college, understanding the application process, and financing their education, this course will provide tangible ways to successfully navigate all of these benchmarks in the transition to higher education. While this course is open to everyone, the content has been tailored specifically for active duty service members and veterans, especially those who aspire to start school or return to school soon, and higher education professionals who work to support student veterans.

Personal Finance Masterclass

This course will cover everything you need to know when it comes to understanding personal finance and beginning your journey to security. Throughout this course I am going to teach you how to establish a baseline, implement strategies, and reach your goals!

Start A Home Business & Work From Home - The Complete Course

Everything you need to consider when starting a work from home business online! The easy, fun and profitable method. What you'll learn: Learn From A Top Rated Instructor Who Has Been Teaching On Udemy Since 2013 and Taught Over 100,000 Students!Define BusinessUnderstand Costs InvolvedDetermine Your Capital NeedsProperly Price Your Goods/ServiceBasic Accounting and ReportingLegally Establish Your BusinessDefine Your Product/ServiceBuild a Strategy To Reach Your CustomersBranding and MarketingFinding Great AdvisorsCompensate Your StaffForecast Your Financial ResultsFund Your BusinessKnow and Understand Your MarketDetermine Your RevenueKnow Your CompetitorsSell and Deliver Your Product/ServiceCreate a Winning TeamManage Your SuppliersCreate an Organizational ChartGoal SettingSuccessfully Launch Your Business Do You Have A Passion To Start Your Own Business FromHome?Do You Have An Idea For A Business?Do You Dream Of A Lifestyle of Freedom?Do You Not Know Where To Start?If YouAnswered "Yes" To Any Of The Above, LookNo Further. This IsThe Course For You!*** Updated with new content!***Enroll today and join the 100,000+successful students Ihave taught as a Top Rated Udemy instructor!Three reasons to TAKETHISCOURSEright now:You getlifetime accessto lectures, including all new lectures, assignments, quizzes and downloadsYou canask me questionsandsee me respondto every single one of them thoroughly!You will are being taught bya professional with a proven track record of success!Bonus reason:Udemy has a 30 day 100% no questions asked money back guarantee! Recent Reviews:Mike P says "Wow, Iwent from not having a clue how to start a business to feeling like I can take on the world! Chris really knows his stuff, I'd recommend this course to anyone wanting to start a business. So much content is covered. I can't thank you enough."WhatYou Will LearnIn this course you will learn how tostartan onlinebusiness. As an early stage entrepreneur, you may have an amazing idea, but are not sure how to proceed. This course covers all of the basics you need to start thinking about today in order to properly launch your online business and experiencetremendous success. Iwill walk you through all the steps!Determine what profitable niche you will start a business inBuild a marketing planDetermine how to capitalize and fund your businessLegal formation of your businessCorporate taxesTrademarks, copyrights, patentsAccounting 101PayrollInventory - drop shipping vs. holding inventoryWhere to establish your business onlineCompetitionTime commitmentsAnd Much Much More!We start with planning - what do you sell, creating a business and marketing plan, and planning your attack! Marketing strategies and considerations are discussed, along with legal and accounting aspects of starting a company. We talk about site design and usability, as well as time management, inventory management, accounting software, and growth.This course highlights all the steps to take to startyour business today!If you are an entrepreneur and flustered or overwhelmed with the concept of starting an onlinecompany, fret not. Watch the 2+ hours of course content, and be ready to get your company going ASAP.Iwill help you!At any point during the course if you are confused or need clarification, send me a message!I'm here to help YOUthe student, and I love interacting with you. I've been in accounting & finance over 25 years and can most likely answer your question.Ihave also included a copy of my ebook "Fund Your Startup by ChrisBenjamin" which you will find as a download in the last lecture. Learn your options for funding, where to find investors, how to wow them, and lastly the must do steps to successful funding!*** CLICK "BUY NOW" AND LEARN WITH ME HOW YOU CAN START YOUR OWN HOME BUSINESS TODAY!! ***About The InstructorChris Benjamin, MBA&CFO is a seasoned professional with over 25 years experience in accounting, finance, startup companies, entrepreneurship, and online business. Having spent the first 10 years of my career in corporate settings with both large and small companies, I learned a lot about the accounting process, managing accounting departments, financial reporting, external reporting to board of directors and the Securities and Exchange Commission, and working with external auditors. The following 10+years Idecided to go into CFOConsulting, working with growing companies and bringing CFOlevel experience to companies. I help implement proper best business practices in accounting and finance, consult on implementation of accounting systems, implementing accounting procedures, while also still fulfilling the CFOroll for many of my clients which includes financial reporting, auditing, working with investors, financial analysis and much more.Thank you for signing up for this course on Udemy. I look forward to being your instructor for this course and many more!Chris Benjamin, Instructor,CFO&MBA

Dream it, Do it: Breaking Into The Music Industry

Breaking into the music industry is the dream you share with pretty much everyone else on the planet. And there is a whole infrastructure designed to keep you out. But you don’t have to obey the gatekeepers. Steve Rennie is here to show you how to carve your own path to success.With over 30 years in the music business as a concert promoter and former manager of platinum-selling rock band Incubus, Steve draws on his experience to coach and mentor the next generation of artists and music pros. In Dream it, Do it: Breaking Into The Music Industry, Steve is going let you in on what it takes to get your foot in the door and where to go from there. You’ll learn how to find a way over, around, or through anybody, or anything standing in your way. You’ll get straight-shooter insight on what separates winners from losers to how to strike when the iron is hot.Talent is common, but having what it takes to make it in the music biz is an entirely different set of skills. Steve is here to teach them to you.

Creating Innovative Business Models

This course was created to guide aspiring and active startup entrepreneurs and corporate innovators that feel... Overwhelmed by the tasks of creating a new venture Frustrated with finding the right team at the right time Disappointed by the widespread failure of bringing good ideas to market It’s common to desire... Innovative approaches and tools to help create a startup company or corporate venture Intelligence on what customers really want, and are willing to pay for Insights on the big picture of crafting a startup company, and how the puzzle pieces fit together This course will help you to... Understand the theory and practice of value creation Determine how to build the right team for your startup company or corporate venture Avoid wasting time with startup ideas with limited commercial potential Raise the right financial capital at the right time for the right purpose By the end of this course, you will be positioned to... Effectively design value propositions that directly align with your target customers’ interests Assemble and lead an well-comprised team to produce results that create value for your customers Pursue big ideas that really matter to customers Craft a financial model that minimizes risks and maximizing your success

CT5 Chapter 1 Life Assurance Contracts

In chapter 1 of CT5, we will learn about the fundamental concepts of life assurance contracts. The video starts by explaining that these contracts are based on life expectancy, and there are four main types: whole life assurance, term assurance, endowment assurance, and mixed assurance. MJ, the student-actry, will guide us through the diagrams and formulas to help us understand the basics of each type of contract. We will also explore how TQX and TPX are used in the mathematics behind each type of contract. By the end of this chapter, you should have a solid understanding of the essentials of life assurance contracts.

MMS087 - Budgeting and Cultivating a Dream Lifestyle

Welcome to 'MMS087 - Budgeting and Cultivating a Dream Lifestyle'! In this video, we will explore the art of budgeting for a better life. Our host, Jason Vitag, is an expert in frugal living and entrepreneurship, and he will share valuable insights on how to create a budget that aligns with your financial goals. Whether you want to save for retirement, pay off debt, or simply live more sustainably, this video will provide practical tips and strategies to help you achieve your financial aspirations. Join us as we delve into the world of budgeting and learn how to cultivate a dream lifestyle on a budget!

International Franchise Law: the World is Yours

We each have a daily connection with franchising. At the international level, franchising is a practical and exciting aspect of global commerce. Countries with vast markets and growing middle classes present opportunities for brands that have reached saturation in their original market. Developing countries too are now creating home-grown, exportable franchised brands. Gain an introduction to international franchise law This free online course will introduce you to international franchise law and will enhance your skills in assessing the viability of franchising a business internationally. Since World War 2 business format franchising has grown exponentially and is now entrenched as a trusted business model. But, what many would believe to be a simple business arrangement is anything but that. This introductory course looks at the law behind questions such as: How do franchisors keep their brand image consistent across all countries? What due diligence do franchisors need to conduct? How do franchisors conduct legal due diligence? How are international franchising disputes resolved? What’s the future of business format franchising? Explore real-world challenges through a video-based case study approach The course uses a video-based case study approach which explores real world issues through the experience of Michelle and Brian - a Sydney couple who are dreaming of expanding their boat cleaning business. Through the case study we present a real situation encountered by a business in order to draw out the issues and challenges in setting up and then expanding a franchise. Explore the cultural and legal aspects of franchising We will introduce you to the cultural and legal aspects of franchise relationships and will lead you through some of the laws that have developed, globally, to support business format franchising. In particular, we will explore aspects of franchise agreements, due diligence, franchise disclosure laws, intellectual property laws, relationship laws, dispute resolution, competition law, tax law, and the future of franchising. By the end of this course, you will be able to: Assess the expansion-readiness of a franchised business for overseas jurisdictions Recognise the role of legal advisers in the business decision to expand a franchise to a new country Identify the key legal issues that affect franchisors expanding internationally Identify and research the laws relevant to franchising in international jurisdictions Understand the methods available to resolve franchise disputes Examine the potential future application of the franchise model through social franchising and micro franchising. This course is suitable for undergraduates, postgraduates, financiers and entrepreneurs. Existing and prospective franchisors or business owners and their professional advisers from around the world who are either serious or curious about exploring the idea of internationalizing their business and who want to know more about franchising are welcome. Potential research collaborators are always welcome. If this doesn’t describe you, don’t worry – even if you’re just curious about franchising, you are welcome too.

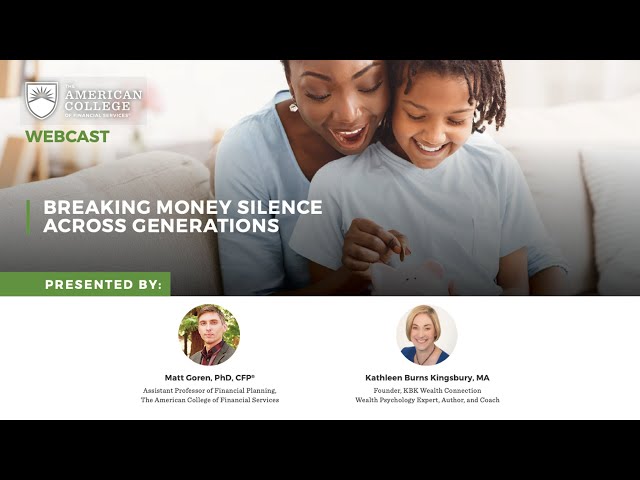

WEBCAST: Breaking Money Silence Across Generations

The webcast 'Breaking Money Silence Across Generations' explores the significance of money conversations across different age groups. Kathleen Burns Kingsbury, a wealth psychology expert, explains that a lack of communication can lead to money silences, which can have a profound impact on financial decisions. The webcast delves into the reasons for these silences, such as fear, shame, and avoidance, and discusses strategies for breaking the silence, including setting ground rules, creating a safe space, and using storytelling to connect with others. The video highlights the importance of engaging individuals, couples, and families in money conversations to ensure financial stability and security across generations.

The art of tidiness at work - Marie Kondo

In this talk, Marie Kondo discusses the art of tidiness at work, sharing her expertise on how to create a clutter-free and organized workspace. She begins by explaining that the key to success is starting small and gradually building up to larger tasks. Kondo emphasizes the importance of touching each item and asking if it sparks joy, a principle she introduced in her book. She also highlights the need for a designated place for everything, so that items are always returned to their proper place after use. Additionally, Kondo stresses the importance of tidying up regularly, rather than waiting until everything is cluttered and disorganized. Throughout the talk, Kondo provides practical tips and advice on how to apply her methodology in a work setting, making it an informative and useful video for anyone looking to improve their workspace organization.

Global Financing Solutions (by EDHEC and Société Générale)

Class Central Tips The MOOC Global Financing Solutions is your online gateway to better understanding of the dynamics of Finance, and its role at the very heart of promoting the “real economy” and global growth. Concretely, you will learn how companies finance themselves using banks and capital markets and how Environmental, Social and Corporate Governance criteria are now deeply integrated in all financing processes. We will look at the role of syndication, and how it links issuers looking to raise capital to grow their businesses with investors looking to manage their assets and possibly liabilities. The role of banks in wider society will also be explored, from helping airlines to lease aircraft, to financing roads and bridges that help promote transport and trade, to funding renewable energy sources such as wind or solar farms, right through to explaining the role of export finance, and the pivotal role exporting countries governments’ play, in promoting the movement of goods worldwide. We will showcase the lifecycle of commodities, from exploration, to processing and refining, to how banks facilitate the global trade of products such as agriculture products or everyday items. We will also look at the exciting world of acquisition finance and leverage buy-outs, enabling strategic moves for industry players, as well as securitization, the repackaging of debt, and hedging, especially important as a mean to protect corporate companies against rate or price fluctuations. Having a positive impact on society and the planet is clearly key for financial institutions. Throughout the whole course, we will illustrate with real cases the recent evolutions finance has gone through to incorporate ESG matters into its business decision making. The collaboration between Societe Generale and EDHEC Business School builds on a long-standing partnership based on one common objective: to provide future talents with access to information and expertise that enables them to grow. Through this MOOC, we are taking an innovative approach to learning by providing you with the theoretical basics of finance, thanks to the expertise of EDHEC as one of the world’s foremost business schools in Finance, and combining it with practical insights of business experts from Societe Generale, widely regarded as a global leader in Structured Finance, to show how the theory is put into practice.

Doing Business in Europe

Class Central Tips Welcome to the MOOC “Doing Business in Europe”! Europe is a major world trade partner as well as a place where to acquire significant business experience. This is the reason why this MOOC has been designed with the view to explaining and guiding you in doing business in Europe. Do you really know Europe? How should you consider and approach the European continent? What business lessons can be drawn in a European perspective? With a dozen contributions from academics in the various domains of management (marketing, supply chain, finance, human resources management or strategy) and as many testimonials from business leaders operating in Europe, this course will help you enrich your knowledge and business competences within the European context. The MOOC is divided into 5 topics corresponding to 5 major issues when doing business in Europe: 1. Approaching the European market(s) 2. Innovating in Europe 3. Investing in Europe 4. Building the value chain 5. Integrating the diversity There are no prerequisite for this course. At the end of the coursework, participants will be able to understand how to design a European-scale development strategy. Please enroll and thank you in advance for choosing this course!

India Customs and Allied laws

Want to start a career as a Customs professional in India or want to enhance your knowledge in the field of Customs? Companies seek individuals with Customs expertise to help them adopt correct compliance positions and manage imports and exports effectively. This requirement is not only from a Customs compliance standpoint but also from the perspective of guiding on the interplay of Customs compliance with the operational and logistics aspects of the business. They are responsible for preparing and filing documents, analysing issues that may attract Customs duty liability, adopting the correct position under Customs laws, identifying duty optimisation schemes or opportunities, and keeping pace with the international business environment. Designed by PwC India, this program will help you gain both academic insights and skills in the field of Customs and Foreign Trade Policy. You will’ ll learn about the landscape of Indian Customs and foreign trade. You will also gain practical knowledge of Customs laws and principles through case studies that are necessary to solve real-life business problems in the Customs domain. Upon completion, you will earn a Specialization Certificate from PwC India and will have job-ready skills for entry-level Customs jobs in India. This is an industry-agnostic program relevant to anyone looking to acquire basic knowledge of Indian Customs.

Creating a Budget in Libre Calc for a Small Business

In this 1-hour long project-based course, you will learn how to access Libre Calc, understand why budgets are useful and create new tabs, populate budget data into the tabs in an organized way, create formulas within tabs to obtain useful information, create dropdowns using the data validation tool, and link data from multiple tabs into a single sheet, to obtain an overview of the business’ performance. Note: This course works best for learners who are based in the North American region. We’re currently working on providing the same experience in other regions.

Decode the entrepreneur's DNA

You want to start a business, but you’re not sure where to begin? Or perhaps you have a business idea to begin with, but you’re not sure how to take it to the next level? Or you’re not sure you have the qualities for becoming an entrepreneur?Let’s brainstorm together to get you moving!If you want to be an innovative entrepreneur, it doesn’t matter if you don’t have a business idea yet: the first thing you’ll need is a high level of motivation and a few personal skills. I would like to walk you through this process of becoming an entrepreneur by giving you some advice and methods, a few hints, and also inspiring stories of other entrepreneurs. By the end of the course, you will know how to recognize business opportunities and analyze their potential.Once you are done, I will show you in two other courses how to build your venture project and then launch it.You will have to work on yourself and learn how to find your way in the jungle of innovation !

Management and Leadership: Leading a Team

Develop a business plan and build an effective team Developing plans – and building, supporting, growing and improving teams to deliver them – is a key part of management and leadership. This online course will show you how. It has been developed by The Open University Business School – a pioneering institution that is triple accredited by AMBA, EQUIS and AACSB – and the Chartered Management Institute (CMI) – the leading authority on management and leadership in the UK. As such, it will give you the opportunity to learn from both academic experts and experienced practitioners, who have achieved the CMI’s prestigious Chartered Manager status. The course is designed for new or aspiring managers, or experienced managers with few or no formal qualifications. It will enable you to demonstrate your continuous professional development and go on to achieve a CMI Level 5 Award as part of the Management and Leadership, Essentials program. If you also complete and pass the Management and Leadership, Personal Development program, you’ll earn another CMI Level 5 Award. Together, these two awards will give you a CMI Level 5 Certificate in Management and Leadership – the next step to Chartered Manager status. We’ve extended the final assessment date Due to demand we have extended the final assessment registration date until 28th February 2021. We’re working to extend this further and will update this page as soon as this is confirmed.

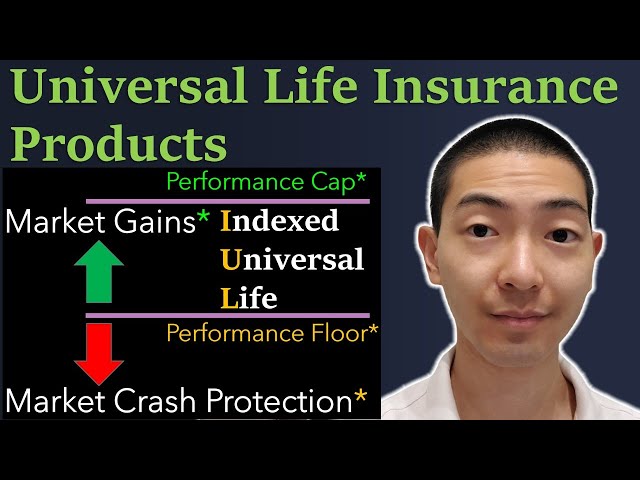

Universal Life Insurance Products Explained | Indexed Universal Life | Variable Universal Life

Universal Life Insurance Products Explained provides an overview of the different types of universal life insurance products available in the market. The video covers how these products work, their characteristics, and who they are suitable for. It also explains the savings component and interest crediting rate in universal life policies. The video highlights the flexibility in premiums, upfront sales and administrative costs, and the guaranteed minimum interest rate. Additionally, it discusses policy loans and withdrawals, and how they accrue interest and reduce the death benefit. Overall, the video provides a comprehensive understanding of universal life insurance products.

Financial Analysis

This course covers financial analysis techniques to evaluate the performance and health of a business, including financial statement analysis, ratio analysis, and forecasting. Students will learn how to interpret financial data to make informed business decisions. The course is designed for professionals in finance, accounting, or business roles who want to enhance their financial analysis skills.

Finance for Everyone: Decisions

Class Central Tips Finance for Everyone: Decisions will introduce you to the workings of the free markets and the foundations of finance. You will learn how free markets and their “creative destruction” provide the architecture for the global economy and how those same markets move money in ways that create and destroy wealth. Your financial toolkit will include timeless concepts like compounding, discounting, annuities, effective interest rates, and more. You will also learn how to simplify important financial calculations and apply that knowledge to real-life decisions that can influence everything from how you pay for your car to where you live. Through peer review you will publish your view on an issue important to you. You will also discover how your applied decisions connect to bigger questions relating to changing market conditions as you prepare for the second course in F4E: Markets.

Common Sense Economics For Life (Part 4)

This course teaches students how to apply common sense economic principles to real-life situations, equipping them with the skills to make informed financial decisions. The course covers topics such as budgeting, saving, investing, and understanding economic indicators. The teaching method involves a combination of lectures, case studies, and practical exercises. This course is designed for individuals who want to improve their financial literacy and make better economic choices in their personal and professional lives.

Personal Finance

Create Your Financial Plan: The Personal Finance Professional Certificate is designed for individuals to build financial literacy, one of the most pressing needs Americans face today. Financial decisions made by individuals impact the larger community in significant ways. A recent study by the Financial Industry Regulatory Authority (FINRA) reveals over 50% of Americans have less than $10,000 saved for retirement. In addition, over 50% of Americans have no emergency fund, unable to cope with an unexpected car repair without borrowing funds. Financial literacy is an urgent need for many and there is a pervasive cost to financial mistakes. With the Personal Finance Professional Certificate, you’ll gain the basic building blocks to build a secure foundation for your future. Designed for the beginner to intermediate learner, the program consists of three courses: Introduction to Personal Financial Planning Managing Personal Cash & Credit Planning for Risk, Retirement & Investment Through these courses, you’ll develop your ability to: Plan for personal success and financial security Take the long view when preparing your financial future Understand budgets, taxes, and the time value of money Explore obstacles to financial success including cognitive errors and confirmation Manage your day-to-day expenses, disbursements, and income Discover the pros and cons of open and secured forms of consumer credit Compare short-term investments and savings products Manage risk in the most cost-effective and productive manner Evaluate various risk-management and insurance products and services Understand your retirement needs from a strategic perspective Create personal freedom and build wealth through a broad perspective of investing Develop a mindset of success, personal freedom, and empowerment

Capital Markets and Key Participants

This course explores the economic interplay between financial intermediaries (indirect finance) and markets (direct finance) in allocating capital and creating investment opportunities. You will learn about global financial markets including how banking and financial markets work together. You will learn about the types of of financial intermediaries and how to identify the drivers behind the global distribution of investment-grade bonds by currency and of equity market capitalization by country.

CFP Certification Exam Study Guide - Certified Financial Planner

If you need to get ready for the CFP Certification exam, why not prepare with this convenient online test preparation course? As you work through the course's engaging lessons and practice assessments, you'll review and reinforce your understanding of all the exam's finance concepts.

Fundamentals of Entrepreneurship in the Family Business

Nowadays, family businesses are indispensable in our economy. However, it is very important to identify the tools and strategies of success that allow them to transcend in a competitive environment. For that reason, this entrepreneurship course gives you the opportunity to know and apply best practices, taking into account entrepreneurship and innovation models that will allow you to take advantage of the strengths that posseses the family business, in order to create a suitable business for next generations. In this entrepreneurship course you will have the opportunity to know the instruments and components that involve entrepreneurship; from ideation, market validation and value proposition, to present your sales plan to attract investors (Business Pitch). This online course delivers the knowledge and tools necessary for the success of a venture in the family business. The Center for Entrepreneurial Families and EGADE Business School of the Tecnológico de Monterrey is the ideal institution to develop these skills, since Tecnológico de Monterrey is the number 1 university in Mexico and the 6th best in Latin America according to Times Higher Education (THE) 2016. Professors at Center for Entrepreneurial Families are highly qualified and recognized as part of the worldwide STEP project for family entrepreneurship, and EGADE Business School is the number 1 business school in Latin America in MBA program, according to the ranking of AméricaEconomía.

Essentials of Corporate Finance Capstone

Class Central Tips The Capstone Project is the final part of the Essentials of Corporate Financial Analysis and Decision-Making MOOC Specialization. The Capstone is designed to allow students to bring together the skills acquired and knowledge gained over the preceding four courses of the Specialization by taking on the role of a financial analyst tasked with advising a wealthy private client on a significant strategic investment in a large listed firm operating across the globe. View the MOOC promotional video here: http://tinyurl.com/j9fqv25

Retire Early with a FIRE Plan - Financial Planning - Part 1

The video begins by emphasizing the importance of having a financial plan for those who want to achieve financial independence and retire early. The speaker highlights that a financial plan is not just about saving money, but also about investing wisely and creating passive income streams. They discuss the different components of a financial plan, including budgeting, saving, investing, and tracking progress. The video also covers the idea of 'financial independence retire early' (FIRE) and how having a solid financial plan can help achieve this goal. Additionally, the speaker shares some personal experiences and insights from their own financial planning journey, providing viewers with practical tips and advice on how to get started with creating their own financial plan. Throughout the video, the speaker stresses the importance of revisiting and updating the financial plan regularly to ensure it remains relevant and effective in achieving financial independence and retirement goals.